▼

Thursday, 30 June 2016

Date : 1.07.2016

Cabinet accepts both two options for fixation of 7th CPC Revised Pension

7th CPC Recommended following Two options for fixation of Revised Pension.

1. Pay Scale on Retirement and Number of Increment Earned in the scale of Retiring Grade will be taken for fixation of Pension

In this method Pension will be fixed in the Pay Matrix on the basis of the Pay Band and Grade Pay at which they retired.

2. Using Multiplication Factor 2.57

Existing Basic Pension to be multiplied by 2.57.

When the NJCA met the Cabinet Secretary, they observed that Govt is not going to accept second option due to non-availability of Records to verify their Pay Level at the retiring stage. Objections were raised by Pensioners Association to this move and they requested the government to retain both two options to avoid disparity between Pre 2016 and Post 2016 Pensioners.

The Central government in principle accepted the two options recommended for fixation of Revised Pension. But to address the issues anticipated when implementation in process, govt decided to constitute a committee to examine the feasibility of using First Option for fixation of Pension. It said, if found feasible, it will be implemented. The Committee has been given four months’ time to submit its report.

The govt decision on Pension related issues is given below

“The general recommendations of the Commission on pension and related benefits have been approved by the Cabinet. Both the options recommended by the Commission as regards pension revision have been accepted subject to feasibility of their implementation. Revision of pension using the second option based on fitment factor of 2.57 shall be implemented immediately. A Committee is being constituted to address the implementation issues anticipated in the first formulation. The first formulation may be made applicable if its implementation is found feasible after examination by proposed Committee which is to submit its Report within 4 months.”

Date : 30.06.2016

7th Pay Commission – Railways, Defence,

Post employees to go on strike from July 11

New Delhi, June 29: Not everyone is happy with the Central government approving the 7th Central Pay Commission (CPC) recommendations. As per latest reports, 33,000 South Western Railway employees will go on an indefinite strike staring July 11. The National Joint Council for Action (NJCA) announced the strike in Karnataka on Tuesday, to pressure the government into fulfilling their demands.

Speaking to the media, A.M. D’Cruz, zonal general secretary and convenor of NJCA said that after trying to voice their concerns, the Union government disregarded their demands and as a last resort, the trade union had decided to call for a strike. D’Cruz also accused the Union government of trying to use coercive methods such a filing cases against the employees to prevent them from participating in the strike, The Hindu reported. “We are ready to be jailed,” he said.

“Two of the most significant issues that have triggered the strike are the inordinate delay in taking decisions on the Pay Commission recommendations and refusal of the government to bring back the old statutory defined benefit scheme of pension to all employees in place of the contributory pension scheme. The government has not shown any interest in addressing our demands that include filling vacant posts, no foreign direct investment in railways and no privatization. They have opposed the labour law amendments. Another demand is to grant one rank, one pension to railway employees,” D’Cruz was quoted by the Times of India.

Having waited three months for the Union government, following assurance by the Cabinet Secretary, their demands were not met. Seeking a reconsideration of the commission, the NJCA has asked for a hike of 26 per cent instead of the present 23.5 per cent. This would also mean a minimum wage of Rs 26,000 as compared to the recommended and approved Rs 18,000.

The NJCA had submitted a charter of 36 demands which include restoring the old pension scheme and doing away with the National Pension scheme, preventing the Labour laws from being amended, and filling vacancies.

Date : 30.06.2016

IPPB MEETING WITH UNIONS

Tommorroe India Post Payment Bank meeting is held at

Postal Directorate ,New Delhi.

Our FNPO S/G Sri.D.Theayagarajan , NAPE G/S Sri. D.Kishan Rao , NAPE P&MTS G/S Sri.T.N.Rahate , NUGDS G/S Sri.P.U.Muraleedharan were attended that meeting.

Meeting mainly concerns with the contribution of GDS in IPPB.

Our leaders opposed so many issues regarding the IPPB consequences faced by the Departmental as well as GDS employees.

IPPB MEETING WITH UNIONS

Tommorroe India Post Payment Bank meeting is held at

Postal Directorate ,New Delhi.

Our FNPO S/G Sri.D.Theayagarajan , NAPE G/S Sri. D.Kishan Rao , NAPE P&MTS G/S Sri.T.N.Rahate , NUGDS G/S Sri.P.U.Muraleedharan were attended that meeting.

Meeting mainly concerns with the contribution of GDS in IPPB.

Our leaders opposed so many issues regarding the IPPB consequences faced by the Departmental as well as GDS employees.

Date : 30.06.2016

Unions reject pay hike, threaten to go on strike

The Confederation of Central Government Employees today rejected the pay hike announced by the government and threatened to go on a strike next week, a decision which got support from the central trade unions.

The Confederation said the pay hike approved by the Cabinet on the 7th Central Pay Commission's recommendations is "not acceptable".

RSS affiliate Bharatiya Mazdoor Sangh (BMS) and other trade unions also rejected the hike, saying this is the lowest increase in the past 17 years that would increase disparity between the minimum and maximum pay.

"In the prevailing economic conditions, the proposed hike as per the Pay Commission is inadequate. It is not acceptable to us," M Duraipandian, General Secretary, Confederation of Central Government Employees and Workers, Tamil Nadu, said.

He added the Confederation will be forced to advance the indefinite strike call to July 4 instead of July 11, if the government does not heed to its demand of revising the hike.

Earlier in the day, its members staged a demonstration at Rajaji Bhavan in Chennai, home to several state government's offices.

All India Trade Union Congress Secretary D L Sachdev said: "It is the lowest increase in last 17 years. Central trade unions will support the strike call given by central government employees."

While, BMS said it will organise country-wide protests on July 8 against the decision, adding the government has "disappointed" the employees and it may lead to industrial unrest.

"The formula should be 3.42 instead of 2.57 as approved by the government. Similarly the annual increment should be 5 per cent instead of 3 per cent given. The disparity between the minimum and maximum pay has also been increased," BMS General Secretary Virjesh Upadhyay said.

In a statement, he said the Sangh will organise protests across the country in all districts on July 8 and will discuss on the alternative of going on a strike at its national executive in August.

BMS also demanded for a uniform minimum pay of Rs 18,000 per month to all the workers including the private sector.

Date : 30.06.2016

Over 60 financial giants like Barclays,

Citibank, Deutsche Bank line up to

partner with India Post

NEW DELHI: The vast legacy network of India Post, once perceived to be unwanted baggage and a huge financial burden, is turning out to be its biggest strength. Top global financial firms Barclays, Citibank,Deutsche Bank, Western Union, Visa and domestic giants State Bank of India and Punjab National Bank are among over five dozen companies that have queued up to partner with the payments bank arm of the country's postal department.

Even the International Finance Corporation, a member of the World Bank Group, has shown interest in picking up a stake in the business.

There are nearly 1.5 lakh post offices across the country, 1.3 lakh in rural India. A modernisation drive across these branches and rollout of core banking solutions and ATMs has attracted the attention of the big boys of the financial world looking at opportunities in banking, MFs, insurance and money transfer.

A large-scale modernisation drive across these branches, including computerisation and the gradual rollout of core banking solutions and ATMs, has attracted the attention of the big boys of the financial world who are looking at new opportunities in banking, mutual funds, insurance and money transfer.

A large-scale modernisation drive across these branches, including computerisation and the gradual rollout of core banking solutions and ATMs, has attracted the attention of the big boys of the financial world who are looking at new opportunities in banking, mutual funds, insurance and money transfer.

The postal network and services are the backbone for lastmile connectivity across the country and our efforts at modernization as well as digitization are bearing fruit," telecom and IT minister Ravi Shankar Prasad, who is also in charge of the Department of Posts, told TOI. "With India Post having got a payments bank licence, there is a scramble to forge partnerships and alliances."

The postal department bagged a licence for a payments bank from the Reserve Bank of India in August last year. The central bank also allowed 10 other firms and tech companies to operate payment banks, considered the likely new disruptive force on the financial landscape of the country.Payments banks can accept deposits up to Rs 1 lakh but cannot grant loans.

They can deposit their money in government bonds and issue debit cards but not credit cards. These banks are expected to spread financial inclusion across the country and bring down cost of remit tance and fund transfer.

The interest in partnerships with the postal department comes against the backdrop of the success that India Post has achieved after tying up with over 800 e-commerce companies, including Flipkart, Snapdeal and Amazon.Parcel revenue, which registered a dip of 2% in 2013-14, grew 45% in 2014-15 and a staggering 100% till February in 2015-16.Those seeking an alliance with India Post for banking products and services include SBI, PNB, BoB, Union Bank, and IDBI Bank. Foreign aspirants include Barclays Bank, Deutsche Bank and HSBC.

In the queue for an alliance on the insurance business are HDFC Life, ICICI Lombard, ICICI Prudential, Bajaj Allianz, Kotak Life Insurance, Royal Sundaram and PNB Metlife.

Transfort and Western Union from the US have lined up for a deal on money transfer.State-owned telecom company BNSL wants to strike a partnership for the mobile wallet business, while American financial services giant Visa has approached India Post for a pact on ATM and point-of-sale transactions.

Over 60 financial giants like Barclays,

Citibank, Deutsche Bank line up to

partner with India Post

NEW DELHI: The vast legacy network of India Post, once perceived to be unwanted baggage and a huge financial burden, is turning out to be its biggest strength. Top global financial firms Barclays, Citibank,Deutsche Bank, Western Union, Visa and domestic giants State Bank of India and Punjab National Bank are among over five dozen companies that have queued up to partner with the payments bank arm of the country's postal department.

Even the International Finance Corporation, a member of the World Bank Group, has shown interest in picking up a stake in the business.

There are nearly 1.5 lakh post offices across the country, 1.3 lakh in rural India. A modernisation drive across these branches and rollout of core banking solutions and ATMs has attracted the attention of the big boys of the financial world looking at opportunities in banking, MFs, insurance and money transfer.

A large-scale modernisation drive across these branches, including computerisation and the gradual rollout of core banking solutions and ATMs, has attracted the attention of the big boys of the financial world who are looking at new opportunities in banking, mutual funds, insurance and money transfer.

A large-scale modernisation drive across these branches, including computerisation and the gradual rollout of core banking solutions and ATMs, has attracted the attention of the big boys of the financial world who are looking at new opportunities in banking, mutual funds, insurance and money transfer. The postal network and services are the backbone for lastmile connectivity across the country and our efforts at modernization as well as digitization are bearing fruit," telecom and IT minister Ravi Shankar Prasad, who is also in charge of the Department of Posts, told TOI. "With India Post having got a payments bank licence, there is a scramble to forge partnerships and alliances."

They can deposit their money in government bonds and issue debit cards but not credit cards. These banks are expected to spread financial inclusion across the country and bring down cost of remit tance and fund transfer.

The interest in partnerships with the postal department comes against the backdrop of the success that India Post has achieved after tying up with over 800 e-commerce companies, including Flipkart, Snapdeal and Amazon.Parcel revenue, which registered a dip of 2% in 2013-14, grew 45% in 2014-15 and a staggering 100% till February in 2015-16.Those seeking an alliance with India Post for banking products and services include SBI, PNB, BoB, Union Bank, and IDBI Bank. Foreign aspirants include Barclays Bank, Deutsche Bank and HSBC.

In the queue for an alliance on the insurance business are HDFC Life, ICICI Lombard, ICICI Prudential, Bajaj Allianz, Kotak Life Insurance, Royal Sundaram and PNB Metlife.

Transfort and Western Union from the US have lined up for a deal on money transfer.State-owned telecom company BNSL wants to strike a partnership for the mobile wallet business, while American financial services giant Visa has approached India Post for a pact on ATM and point-of-sale transactions.

Jun 30, 2016

7th CPC Recommendation on CGEGIS is not accepted by Government

7th CPC Recommendation on CGEGIS is not accepted by Government

7th CPC Recommendation on CGEGIS is not accepted by Govt and the old scheme and rates continues

The 7th Pay Commission has recommended the following rates for Central government Employees Group Insurance Scheme (CGEGIS) . The subscription amount has been increased considerably to increase the Insurance amount .

| Level of Employee | Monthly Deduction (Rs.) | Insurance Amount (Rs.) |

| 10 and above | 5000 | 50,00,000 |

| 6 to 9 | 2500 | 25,00,000 |

| 1 to 5 | 1500 | 15,00,000 |

This has been objected by NCJCM in its memorandum. The demanded to reduce the monthly deduction as it is much higher than the Premium rates available for Term life Insurance in Open Market. The Central Government accepted this demand and rejected this recommendation and asked Ministry of Finance to work out a customized group insurance scheme for Central Government Employees with low premium and high risk cover.

The Press release issued by the Central Government says,

” The Cabinet also decided not to accept the steep hike in monthly contribution towards Central Government Employees Group Insurance Scheme (CGEGIS) recommended by the Commission. The existing rates of monthly contribution will continue. This will increase the take home salary of employees at lower levels by Rs. 1470. However, considering the need for social security of employees, the Cabinet has asked Ministry of Finance to work out a customized group insurance scheme for Central Government Employees with low premium and high risk cover.”

Wednesday, 29 June 2016

Date : 30.06.2016

Seventh Pay Commission: Who’s Got a Raise?

In November 2015, the Seventh Central Pay Commission recommended changes in the pay of around 1 crore individuals — 33 lakh central government employees, 14 lakh armed forces personnel, and 52 lakh pensioners.

The central government periodically sets up a Pay Commission to evaluate and recommend revisions of salaries and pensions for its employees. In November 2015, the Seventh Central Pay Commission recommended changes in the pay of around 1 crore individuals — 33 lakh central government employees, 14 lakh armed forces personnel, and 52 lakh pensioners. On Wednesday evening, Finance Minister Arun Jaitley told a press conference that the government had decided to “by and large” accept the recommendations.

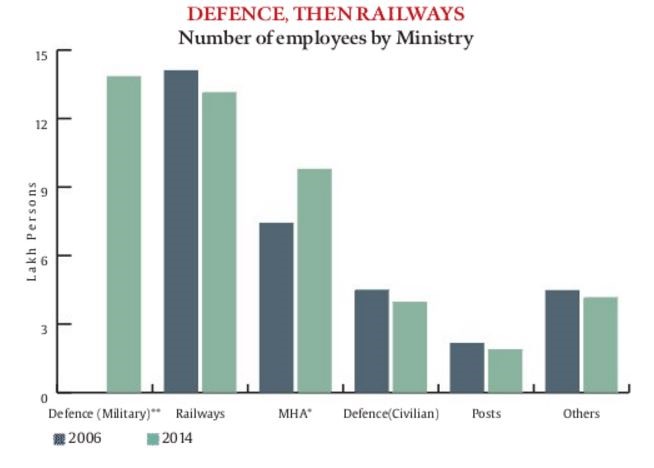

> Central government employs 8.5% of India’s organised workforce. The Armed Forces are the country’s biggest employer.

The central government’s share in organised sector employment has gradually fallen over the past 15 years. In 1994, 12.4% of the organised workforce were central government employees; in 2012 they were only 8.5%.

Sources: Economic Survey of India, PRS; *Provisional data

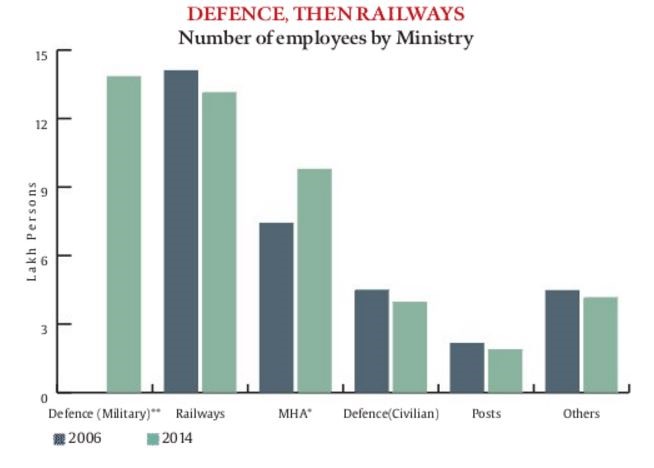

In 2014, the central government employed 47 lakh — nearly 30% (14 lakh) of whom were armed forces personnel. The Railways followed close behind, with a 28% share in employees. Between 2006 and 2014, all ministries except Home saw a decrease in employees. The number of MHA employees (including the paramilitary forces) went up by 32% during this period.

Sources: Report of the Seventh Central Pay Commission, PRS; *Includes Central Armed Police Forces; **Data for Defence (military) not available for 2006

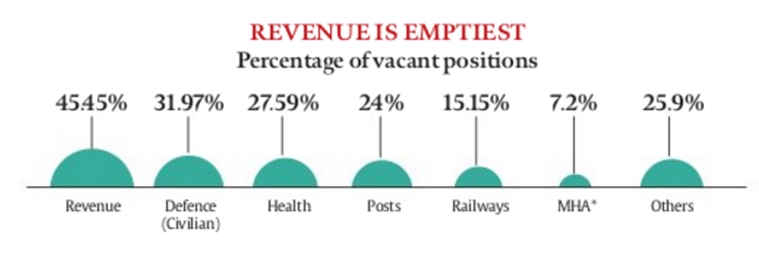

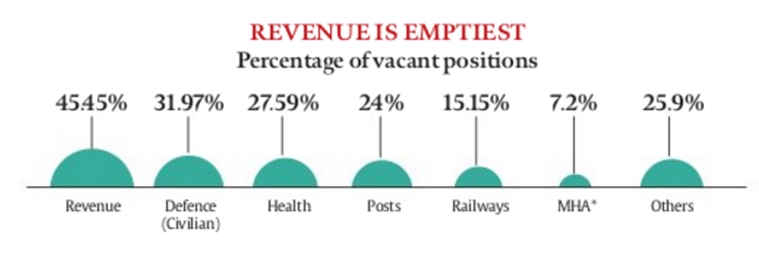

> 89% of all employees belong to Group C. 1 in 5 central government positions is vacant.

88.7% belong to Group C (those providing assistance), followed by Group B (8.5%; middle management) and Group A (2.8%; those who hold the higher administrative positions).

Sources: Report of the Seventh Central Pay Commission, PRS

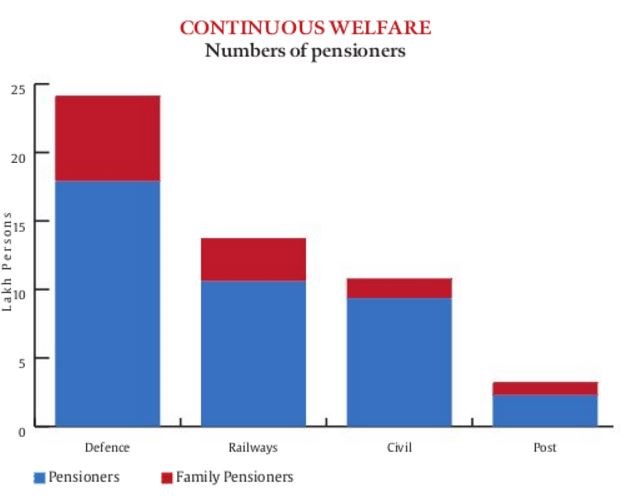

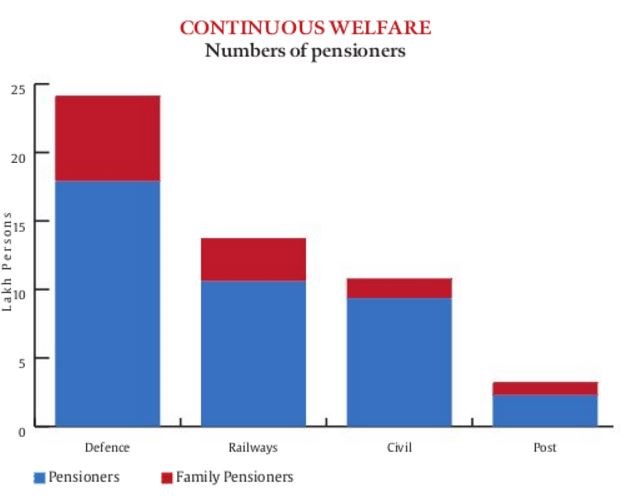

> Defence personnel constitute largest share among pensioners, followed by the Railways

7.47 lakh positions are vacant in the central government, excluding in the Armed Forces — a vacancy of 18.5%. The Revenue Department is the emptiest, with vacancies adding up to 45% of sanctioned strength. In terms of numbers, the Railways has the most unfilled positions — 2.35 lakh.

Sources: Report of the Seventh Central Pay Commission, PRS; *Includes Central Armed Police Forces

Defence personnel constitute largest share among pensioners, followed by the Railways

As of January 2014, central government pensioners numbered 51.96 lakh. Defence personnel constituted 46.5% of the total, followed by Railways (26.5%). The large share of defence personnel may be due to early retirement of these personnel as compared to other government employees.

Sources: Report of the Seventh Central Pay Commission, PRS

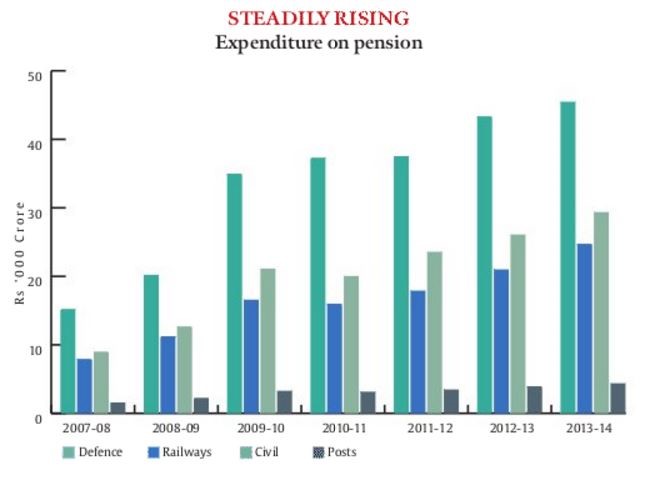

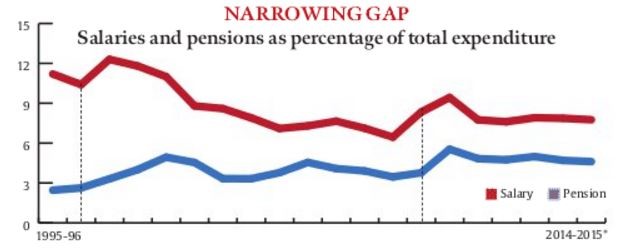

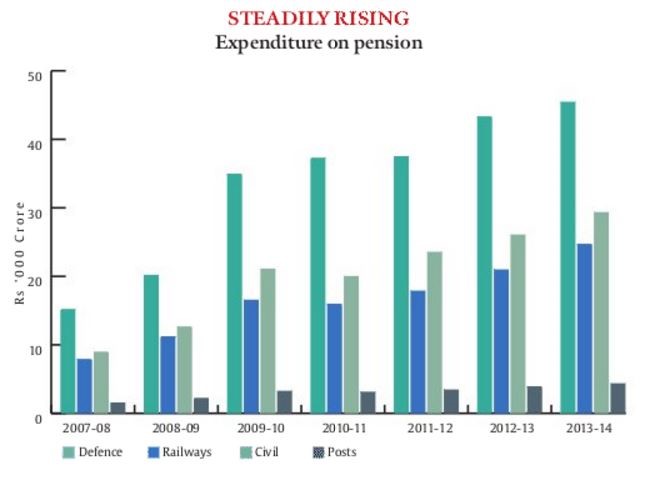

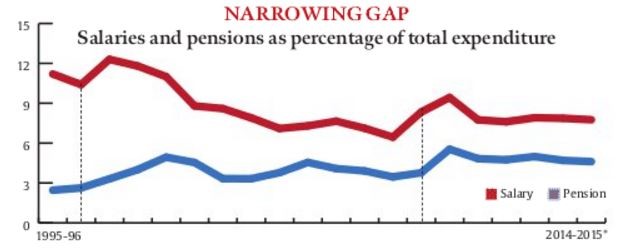

> Nearly 8% of total spending is on salaries; well above half of that is on pensions

In 2014-15, the central government is expected to spend 7.8% of its total expenditure on salaries, and 4.6% on pensions. Expenditure on salaries and pensions spiked after the 5th and 6th Pay Commission recommendations were implemented in 1997-98 and 2008-09 respectively.

Sources: Indian Public Finance Statistics, Ministry of Finance, PRS; Dotted lines indicate year of submission of Pay Commission Report; *2013-14 (Revised Estimates), 2014-15 (Budget Estimates)

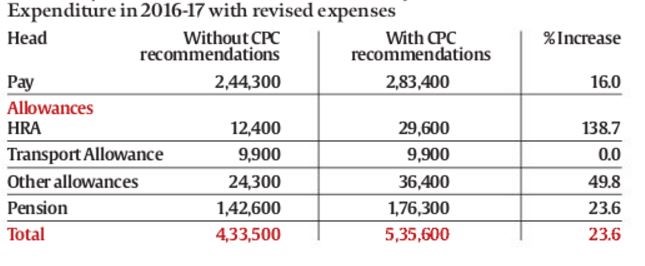

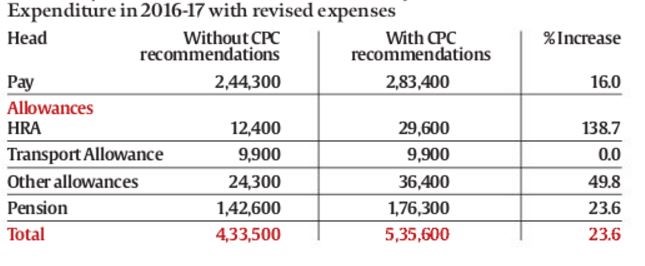

Overall expenditure is estimated to increase by 23.6%

> Government expenditure on pay, allowances and pension (PAP) is expected to increase by 23.6%

> Expenditure on pay is expected to increase by 16%, on allowances by 63%, and on pension by 24%

> Additional expenditure is expected to increase the ratio of PAP as percent of GDP from 2.8% in 2015-16 to 3.4% in 2016-17

> Expenditure on pay is expected to increase by 16%, on allowances by 63%, and on pension by 24%

> Additional expenditure is expected to increase the ratio of PAP as percent of GDP from 2.8% in 2015-16 to 3.4% in 2016-17

Sources: Report of the Seventh Central Pay Commission, PRS; Figures in Rupees crore

DATA COURTESY: PRS LEGISLATIVE RESEARCH All calculations based on recommendations of the Seventh Pay Commission

No More Spreadsheets! Analyze Your data Witho

No More Spreadsheets! Analyze Your data Witho

- Say yes to 5+2 seating of Datsun GO+Datsun India

- Guide for the first 10 days of your babyJohnson & JohnsoBring home the powerful Nissan

Date 30.06.2016

Percentage of HRA in 7th pay commission after cabinet approval

Percentage of HRA in 7th pay commission after cabinet approval

The Pay commission has recommended HRA should be rationalized by using the factor 0.8 which is used for rationalising the percentage based allowances. The 7th CPC recommended 24 percent, 16 percent and 8 percent of the Basic Pay for Class X, Y and Z cities respectively. The Commission also recommended that the rate of HRA will be revised to 27 percent, 18 percent and 9 percent when DA crosses 50 percent, and further revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

The cabinet committee reviewed the recommendations on Allowances and they are not able to give a decision over the Allowances. Hence the Union Cabinet decided to constitute a Committee headed by Finance Secretary for further examination of the recommendations of 7th CPC on Allowances. And it is said that the Committee will complete its work in a time bound manner and submit its reports within a period of 4 months.

In the press release issued by government said the following

” The Commission examined a total of 196 existing Allowances and, by way of rationalization, recommended abolition of 51 Allowances and subsuming of 37 Allowances. Given the significant changes in the existing provisions for Allowances which may have wide ranging implications, the Cabinet decided to constitute a Committee headed by Finance Secretary for further examination of the recommendations of 7th CPC on Allowances. The Committee will complete its work in a time bound manner and submit its reports within a period of 4 months. Till a final decision, all existing Allowances will continue to be paid at the existing rates.”

Since the House Rent Allowance also listed among one of these 196 Allowances, the status HRA is not clear now. The existing rates of HRA is 30%, 20% and 10% for class X, Y and Z respectively. Whether these existing rates of HRA will be paid based on revised pay or pre revised pay..? It needs to be clarified when implementation of 7th pay commission is in process.

Date : 30.06.2016

7th Pay Commission – Railways, Defence, Post employees to go on strike from July 11

New Delhi, June 29: Not everyone is happy with the Central government approving the 7th Central Pay Commission (CPC) recommendations. As per latest reports, 33,000 South Western Railway employees will go on an indefinite strike staring July 11. The National Joint Council for Action (NJCA) announced the strike in Karnataka on Tuesday, to pressure the government into fulfilling their demands.

Speaking to the media, A.M. D’Cruz, zonal general secretary and convenor of NJCA said that after trying to voice their concerns, the Union government disregarded their demands and as a last resort, the trade union had decided to call for a strike. D’Cruz also accused the Union government of trying to use coercive methods such a filing cases against the employees to prevent them from participating in the strike, The Hindu reported. “We are ready to be jailed,” he said.

“Two of the most significant issues that have triggered the strike are the inordinate delay in taking decisions on the Pay Commission recommendations and refusal of the government to bring back the old statutory defined benefit scheme of pension to all employees in place of the contributory pension scheme. The government has not shown any interest in addressing our demands that include filling vacant posts, no foreign direct investment in railways and no privatization. They have opposed the labour law amendments. Another demand is to grant one rank, one pension to railway employees,” D’Cruz was quoted by the Times of India.

Having waited three months for the Union government, following assurance by the Cabinet Secretary, their demands were not met. Seeking a reconsideration of the commission, the NJCA has asked for a hike of 26 per cent instead of the present 23.5 per cent. This would also mean a minimum wage of Rs 26,000 as compared to the recommended and approved Rs 18,000.

The NJCA had submitted a charter of 36 demands which include restoring the old pension scheme and doing away with the National Pension scheme, preventing the Labour laws from being amended, and filling vacancies.